Depreciation On Business Accounting And Tax Forms

Leave your thoughts

Is Depreciation A Source Of Funds?

How do you record depreciation in cash flow?

As the depreciation is taken out when calculating net profit and it is not a cash expense, depreciation is added back while calculating the cash flow statement using indirect method. In a nutshell, depreciation is an accounting measure and added back to revenue or net sales while calculating the company’s cash flow.

For instance, if you’re seeking to secure exterior funding from a financial institution or enterprise capital firm, they’re more likely to be excited about your working cash move. The same goes should you start working with an accountant or monetary marketing consultant — so it’s essential to know what OCF seems like for you before in search of funding. But for small businesses, in particular, money move can also be one of the essential components that contributes to your business’ monetary well being. So a lot so that one study confirmed that 30% of businesses fail as a result of the proprietor runs out of cash and 60% of small business homeowners don’t feel knowledgeable about accounting or finance. Another accelerated depreciation method is the Sum of Years’ Digits Method.

Join Pro Or Pro Plus And Get Lifetime Access To Our Premium Materials

In fact, sometimes corporations use accelerated depreciation to charge larger depreciation expense in certain intervals once they expect to have higher income to purposely lower taxable revenue and achieve tax savings. However, depreciation solely exists as a result is depreciation a source of cash flow of it is associated with a set asset. When that mounted asset was initially bought, there was a money outflow to pay for the asset. Thus, the web positive impact on money flow of depreciation is nullified by the underlying cost for a hard and fast asset.

How Do Depreciation Expenses Present In Statement Of Cash Flow?

If you unload a big asset, your free cash circulate would go way up—however that doesn’t replicate typical money move for your business. However, in reality, companies don’t think about the service benefit patterns when deciding on a depreciation technique. In general, solely a single method is applied to the entire company’s depreciable belongings. It comprises of the acquisition price of the fixed asset and the other prices incurred to place the asset into working condition. These prices include freight and transportation, installation value, fee, insurance, and so forth.

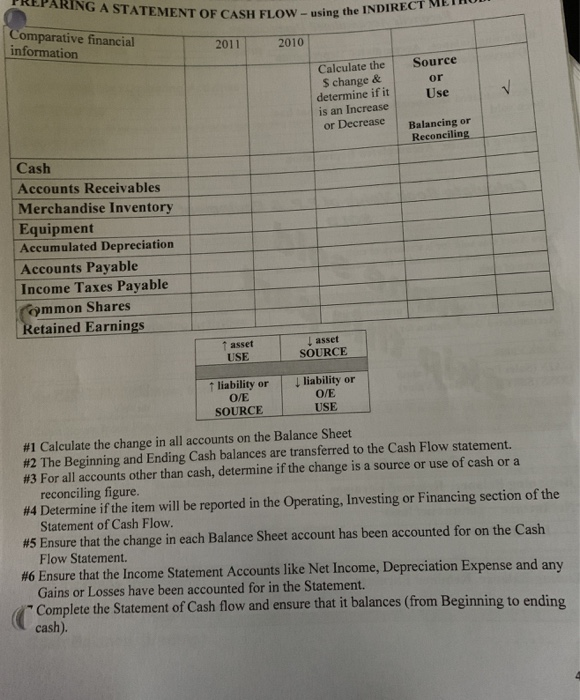

Presentation In Cash Flow Statement Prepared Using Indirect Method:

Is depreciation an asset?

As we mentioned above, depreciation is not a current asset. It is also not a fixed asset. Depreciation is the method of accounting used to allocate the cost of a fixed asset over its useful life and is used to account for declines in value.

Depreciation using the straight-line method reflects the consumption of the asset over time and is calculated by subtracting the salvage worth from the asset’s buy price. A enterprise that doesn’t account for the depreciation of its belongings can anticipate a big impact on its income.

- In effect the noncash depreciation expense is added back because the depreciation expense had reduced the corporate’s internet revenue reported on the earnings statement, nevertheless it didn’t use any money during that time frame.

- The complete quantity of depreciation expense is recognized as accrued depreciation on an organization’s stability sheet and subtracts from the gross quantity of mounted belongings reported.

- Depreciation is the gradual charging to expense of an asset’s cost over its anticipated useful life.

- Financial statements are written information that convey the enterprise activities and the monetary performance of an organization.

- This additionally explains why the working activities section of the assertion of money flows usually begins with an organization’s net earnings and then immediately provides the period’s depreciation expense.

- The amount of amassed depreciation increases over time as monthly depreciation bills are charged towards a company’s property.

Using the oblique methodology, every non-money merchandise is added again to web earnings to supply money from operations. In this case, money from operations is over 5 instances as a lot as reported web earnings, making it a valuable tool for investors in evaluating AT&T’s monetary power. A section of the statement of cash flows that features money activities associated to web income, similar to cash receipts from sales revenue and money payments for merchandise.

What is cash flow formula?

The basic OCF formula is: Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital.

The objective of this lesson is to explain the merits of a cash flow report and when it may be needed. However, you will most likely discover that almost all of small companies don’t find this report necessary – a profit and loss assertion is often all they require for their https://cryptolisting.org/blog/how-can-a-company-have-a-profit-but-not-have-cash tax and planning needs. Accounts payable, tax liabilities, and accrued bills are frequent examples of liabilities for which a change in value is reflected in money move from operations. GAAP is a set of accounting requirements that set rules for the way monetary statements are prepared.

This is one thing you will probably come to understand if you attempt to re-promote the item—typically, you will not get the same price you initially paid. If you run a enterprise, you possibly can claim the value is depreciation a source of cash flow of depreciation of an asset as a tax deduction. In this article, we define the basics of depreciation and the best way to calculate this value for tax purposes. For instance, suppose firm A buys a production machine for $50,000, the expected useful life is 5 years, and the salvage value is $5,000.

While the amount of depreciation expense is not a source of cash, it does cut back a company’s taxable earnings. That in turn reduces a worthwhile company’s money funds for earnings taxes (by the quantity of the company’s income tax rate). Over the lifetime https://cex.io/ of an asset, whole depreciation will be equal to the web capital expenditure. This means if an organization often has more CapEx than depreciation, its asset base is rising. Depreciation expense is used to scale back the value of plant, property, and tools to match its use, and wear and tear, over time.

In actuality, revenues can not all the time be directly related to a selected fixed asset. Instead, they will more simply be associated %keywords% with an entire system of production or group of property. Accounts payable is considered a current liability, not an asset, on the balance sheet.

A part of the statement of cash flows that includes money activities related to noncurrent belongings, similar to money receipts from the sale of kit and money funds for the acquisition of long-time period investments. For example, money generated from the sale of goods (revenue) and money paid for merchandise (expense) are operating activities as a result of revenues and bills are included in net revenue. With the truck in the previous instance, your business spent the cash upfront.

Accumulated depreciation, then again, should–however usually just isn’t–listed instantly beneath the depreciation of the merchandise to indicate the operating https://www.binance.com/ complete. This makes it a neater learn for the accountant and offers a more astute sense into the lifetime of the item from a business perspective.

While free money circulate gives you a good idea of the cash out there to reinvest in the business, it doesn’t always show essentially the most accurate image of your regular, everyday cash flow. That’s because the FCF method doesn’t account for irregular spending, earning, or investments.

Depreciation expense is used to raised reflect the expense and value of an extended-term asset as it pertains to the revenue it generates. If using the double-declining balance method (DDB), which is arguably the most popular, the depreciation price in the above formulation is 2. For instance %keywords%, an organization purchases a chunk of printing equipment for $100,000. As an instance, Company ABC purchased a piece of apparatus for $250,000 firstly of the yr. The equipment’s residual value is $25,000, with an expected helpful lifetime of 10 years.

Categorised in: Crypto Trading

This post was written by robbie